Delivering what counts: The link between CEO pay and shareholder return

Delivering what counts: The link between CEO pay and shareholder return

August 25, 2021 | By Professor Ron Schmidt

This blog summarizes my recent research on CEO pay, which documents a strong relationship between CEO pay and shareholder return. That conclusion differs from the claims advanced in many opinion essays, in reporting by some business journalists, and even in discussion of CEO compensation by some economists. I show that these investigators form misleading conclusions about the relationship between CEO pay and shareholder returns because they typically examine annual measures of pay and return. Instead, I measure pay and returns over a CEO’s full period of service, and I explain why doing so reveals a much strong relationship between them than exists between the annual measures. I describe the measurement procedure and describe statistical analysis revealing that boards consider both shareholder and market returns when setting pay. I show that a larger shareholder return boosts pay but will not do so when that return is matched by a market return of the same size. In other words, a statistically important fraction of boards appears to be attending to shareholder interests by making pay decisions that result in shareholder return and market return affecting CEO pay in ways that are opposite in direction and of approximately the same absolute size.

This is the first in a series of blog posts. Subsequent blogs will address income inequality, which some claim is the result of high CEO pay, and look critically at historical comparisons of CEO pay and pay for other workers.

Presumably, CEO pay has become part of the income inequality discussion because those managing S&P 500 companies do earn much more than even individuals whose incomes are in the top one percent. In 2018, approximately 151M tax returns were filed, but only 22,112 returns declared Adjusted Gross Income of $10M or more. In that same year, average pay for S&P 500 CEOs was approximately $17M, meaning a large majority of those executives have incomes larger than 99.99 percent of all filers and larger than 98.5 percent of those in the top one percent. There is no compelling reason, however, why high CEO pay should be a more important determinant of inequality than the pay of professional athletes, the incomes of surgeons, the pay of partners at the top law firms, the pay of the most famous entertainment celebrities, or most certainly the pay of hedge fund managers.

Indeed, much of the reporting on income inequality is even more misleading than the reporting on CEO pay. For example, in a recent New Yorker essay, James Lardner discusses the relationship between CEO compensation and “a four-decade-long national story of sharply rising economic inequality.”1 While claims of this type are common, they are not accurate. The percentage of income earned by the top one percent was certainly much higher in 2018 than it was in 1984 (10.9 percent), but the period of steady increases in the percentage was over by 2000, at which time it had reached 20.4 percent.2 In 2018, the top income percentage of 19.7 percent was lower than its value in 2000. Between 2000 and 2018, the percentage varied between 16.2 percent (in 2002) and 22.8 percent (in 2007). It was less than 20 percent for every year from 2013 to 2018.

Clearly, Lardner has not examined the data on income inequality carefully. But one economist who has, Thomas Piketty, also holds CEOs responsible for the increase in income inequality that occurred at the end of the 20th century. In establishing this link, Piketty, like many others, reveals that he understands little about CEO pay. For example, he claims, “Top managers by and large have the power to set their own remuneration, in some cases without limit and in many cases without any clear relation to their productivity, which in any case is very difficult to estimate in a large organization.”3 In this blog, I present evidence showing this passage to be one of the most misleading claims ever made by an economist. My work finds no evidence of unbounded CEO pay but considerable evidence that many boards are deliberating thoughtfully when they make pay decisions.

What is truly surprising is that some business journalists, who should be knowledgeable about executive pay, have misled their readers about the impact of shareholder returns on CEO pay. Even the Wall Street Journal contributes to misunderstanding when in 2019 they write:

For the fourth straight year, the biggest US companies set CEO pay records in 2018, a Wall Street Journal analysis found, even as a majority delivered negative stock-market returns to their shareholders—a sign of the often-weak relationship between pay and performance. Median compensation rose to $12.4 million for the bosses of S&P 500 companies last year, up 6.6% from 2017 and the highest since the 2008 recession, the Journal analysis found. Yet the median shareholder return for the companies was minus 5.8%, the worst showing since the financial crisis.4

I will show that underlying this inaccurate description of the link between CEO pay and shareholder return is a flawed methodology

Measuring pay for a CEO’s full period of service.

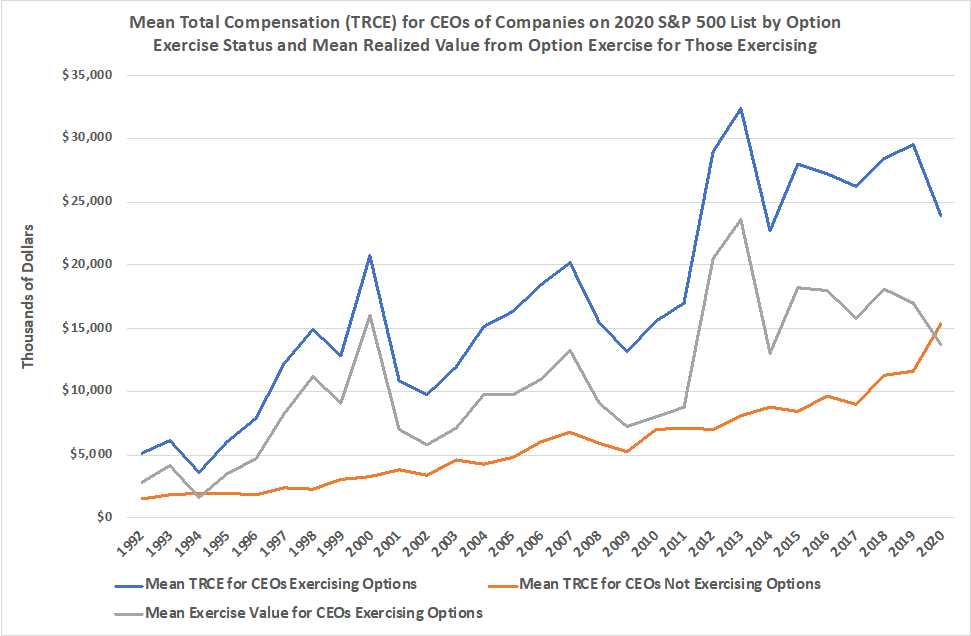

The pay differences between CEOs can appear puzzling when, like the Wall Street Journal, one examines annual measures of pay and shareholder return. This is because stock options constitute an important part of CEO pay. I use a measure of total pay that includes an option component only if options are exercised in a given year.5 If that happens, the value realized upon exercise is part of pay. (I refer to this measure of pay as TRCE, which is an acronym for Total Realized Compensation - Exercise.)

Each year, somewhere between 40 to 60 percent of S&P 500 CEOs exercise the options that were awarded in previous years. Chart-1 shows that the value of exercised options alone realized by those exercising in a given year typically is larger than the average total pay of CEOs who either choose not to exercise or are restricted from exercising options in that year. This pattern of option exercise means that in any year, pay will appear extremely large relative to the return that shareholders earn for the group exercising options but relatively small for those not exercising options.6

Typically, options are not exercisable at the time they are granted. They must be held for a period of time specified by the board that grants them. The amount ultimately realized from the exercise of options will reflect not only shareholder returns in the year of exercise but also the returns realized over the period of time from the date the options were awarded to the date of exercise. In other words, the amount the CEO realizes with exercise of options reflects the cumulative effect on corporate value of the decisions that he or she made.

Looking at annual pay and returns, it follows, is a futile exercise. It is equivalent to assessing the efforts of a MLB baseball team by watching one inning or a NBA team by watching one quarter without paying any attention to a game’s final score. To accurately assess whether CEO pay and shareholder returns are linked, one must measure both over the full period of a CEO’s service.

Chart-1

In a recent paper, I presented evidence of the relationship between CEO pay and shareholder return when both are measured over a CEO’s full period of service. I constructed measures of pay and return for 521 CEOs of companies on the S&P 500 list in 2018. Their periods of service began in 1992 or later and ended in 2019 or earlier. Their minimum period of service was three years, and the longest spanned 19 years. This blog summarizes the results but does not provide a detailed discussion of the statistical analysis.7

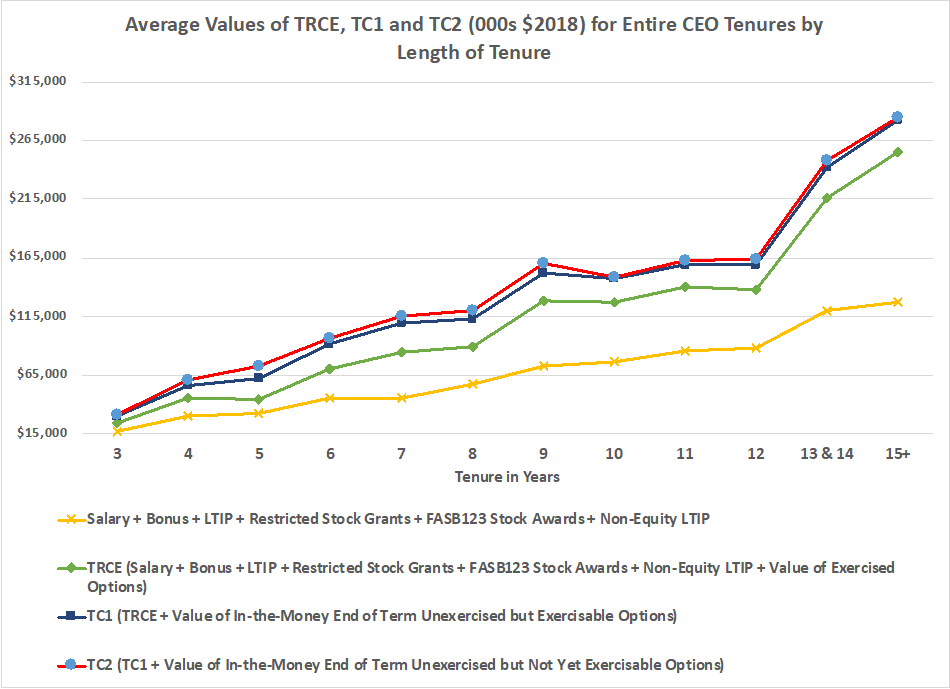

The measure of compensation paid over the CEO’s full period of service that I employed is TC2. It is the sum of his or her annual values of TRCE adjusted for inflation plus the inflation-adjusted value of in-the-money options held at the time the CEO leaves office. An inflation adjustment is necessary to facilitate comparisons of TC2 for CEOs whose periods of service are scattered over a 28-year period. For each CEO, I also calculate the average annual shareholder return and the average annual market return measured by the Value-Weighted Index for his or her period of service. Chart-2 displays the mean values of TC2 by length of service for the 521 CEOs examined. It also specifies the components of TRCE. (LTIP is Long Term Incentive Pay.)

Chart-2

Approximately 80 percent of the 521 CEOs left office with in-the-money options. The value of these options represents a significant amount of pay, particularly for CEOs serving eight years or less. Specifically for that group of CEOs, who represent 60 percent of the 521 CEOs, in-the-money options at the end of the CEO’s term are 40 percent of TRCE and 29 percent of TC2. Any analysis that does not include in-the-money options held by CEOs leaving office will greatly understate the amounts they are paid for their efforts as CEO.

Some might ask whether a CEO holding significant in-the-money options and fearing that a successor would put their value at risk might be tempted to make efforts to extend his or her term of service. Interestingly, the distribution of ages in the last year of service for the 521 CEOs suggest that boards anticipate that possibility and take steps to avoid its consequences by adopting mandatory retirement ages, which are legal when applied to highly paid employees. When their periods of service ended, approximately 300 of the 521 CEOs were between the ages of 60 and 66, with approximately two-thirds of those between the ages of 62 and 65. Only 33 of the executives were at least 67 years old. With mandatory retirement, in-the-money options serve as incentives that encourage the retiring CEO to find a worthy successor. (Piketty does not explain how a CEO can set pay at any level he or she desires but is unable to avoid mandatory retirement.)

Statistical evidence reveals how boards link CEO pay to shareholder and market returns.

The statistical investigation employed two multivariate regressions. Both explain more than 60 percent of the variation in the dependent compensation variable TC2. One was a conventional regression with the actual or transformed observed values of pay and eight independent variables for all 521 CEOs.8

The second regression is more interesting because it minimizes the effects of idiosyncratic board procedures. I label it the difference regression because its variables reflect differences in pay and the independent variables calculated for pairs of consecutively-serving CEOs of the same company.9 The collection of 521 CEOs were employed by 311 companies, with 160 of those companies having at least two but not more than four of the CEOs in the collection of 521. The data for the 370 CEOs who worked for those companies allow calculation of 210 differences for consecutively serving pairs of executives.

In any regression, the measured effects of a variable can represent the combined effects of the variable and any unobserved determinants of pay correlated with it. One important unobserved influence in a pay regression takes the form of the practices boards use to set pay. They certainly vary by industry and even across companies in a single industry.

In the difference regression, however, the effects of variation in board pay practices are minimized, because the pay difference and the differences in the values of the independent variables apply to executives of a single company whose board will have a similar if not identical composition for each pair of CEOs used to construct the differences. If the difference regression provides no evidence of association between pay, and both the shareholder and market return variables, any relationship between those variables in the conventional regression must be viewed skeptically. I place the greatest confidence in variables that are statistically significant in both regressions and have estimated values for the coefficients that are similar.

The regression coefficients for the shareholder return variable in both the conventional and difference regressions are positive, nearly identical in size, and have large t-values (approximately 11.1 for both). Both imply that a one percentage-point increase in shareholder return boosts pay for the CEO’s full period of service by nearly three percent. To assess the quantitative importance of that coefficient, we need to combine it with a measure of the variation across the 521 CEOs in average annual shareholder return achieved. The standard deviation of that return for the 521 CEOs is approximately 12 percentage-points. Thus, if the difference in return achieved for two CEOs were equal to the standard deviation and there were no differences in the other independent variables, the total pay over the full period of service for the CEO achieving the higher return would be more than one-third larger than the pay of the CEO achieving the lower return.

To gauge the absolute amount of the difference, we note that mean annual TC2 (TC2 divided by the years the CEO served) is $15M in $2018 for the 521 CEOs. Thus, a one third pay difference for two CEOs with that same mean would have the higher paid CEO earning an annual average of $17.1M and the lower paid CEO earning $12.9M. Cleary, shareholder return has a significant impact on CEO pay.

The most interesting part of the story, however, is not the size of the shareholder return coefficient but the net effect of shareholder and market return on CEO pay. The coefficient of the market return variable, measured using the Value-Weighted Index, has a statistically significant t-statistic (approximately 5.0), is negative in sign, and has approximately the same absolute value as the shareholder return coefficient. In other words, the shareholder return coefficient implies that a one percentage-point increase in that return will boost pay by nearly three percent, while the Value-Weighted coefficient implies a one percentage-point increase in that return will decrease pay by slightly less than three percent. The absolute values of the two coefficients do not differ statistically. That means the positive effect on pay when a CEO achieves a positive average annual shareholder return of x percent over his or her full period of service is essentially offset when the average annual market return is also x percent for that same period.

That is a powerful result because it implies that boards rightfully take into account the movement of equity markets when making annual pay decisions over a CEO’s period of service. To illustrate, assume two CEOs, A and B, each serve seven years and the only difference in the values of the other variables involve the average annual market return for their periods of service. Specifically, the decisions of A during his or her period of service produce an average annual shareholder return of eight percent when the average market return is also eight percent, while the decisions of B produce the same shareholder return of eight percent during a period when the market return is three percent. To simplify the comparison, assume the shareholder and market returns do not vary substantially by year. The regression results imply that B’s pay will be approximately 15 percent larger than A’s even though both achieve the same shareholder return.

The analysis uncovers the offsetting effects of the two return coefficients because it employs pay and return data for each CEO’s full period of service. The data capture the effect of a series of annual pay decisions that incorporate all the information that the board accumulates about the CEO’s performance. For example, after three years, A’s board is likely to notice the appreciation of any options granted early in his or her tenure but will also recognize that the company’s shareholder return of eight percent was achieved when the market was appreciating at the same annual rate. Alternatively, B’s board after three years is likely to note that his or her eight percent shareholder return was achieved in a much more challenging market.

As a result, B’s board is more likely than A’s to grant additional options, make additional grants of company stock or enhance compensation in other ways during the latter years of the CEO’s term. Those decisions by the two boards will produce B’s predicted 15 percent advantage in total pay for the period he or she serves as CEO. The positive shareholder return coefficient, the negative market return coefficient, their approximately equal absolute values and their clear statistical significance are revealed by statistical analysis because differences in compensation decisions comparable to those between the hypothetical boards of A and B must be common among the boards of S&P 500 companies.

Contrary to the claims of Piketty, CEOs are not setting pay at whatever level they desire. They are being monitored by boards that adjust pay based on what they do and the environment in which they manage. Those boards are doing what every effective executive should do: They consider the environment in which the CEO must operate and provide larger rewards for results that are difficult to achieve, limiting rewards for achievements that are easily accomplished.

Charts speak louder than t-statistics.

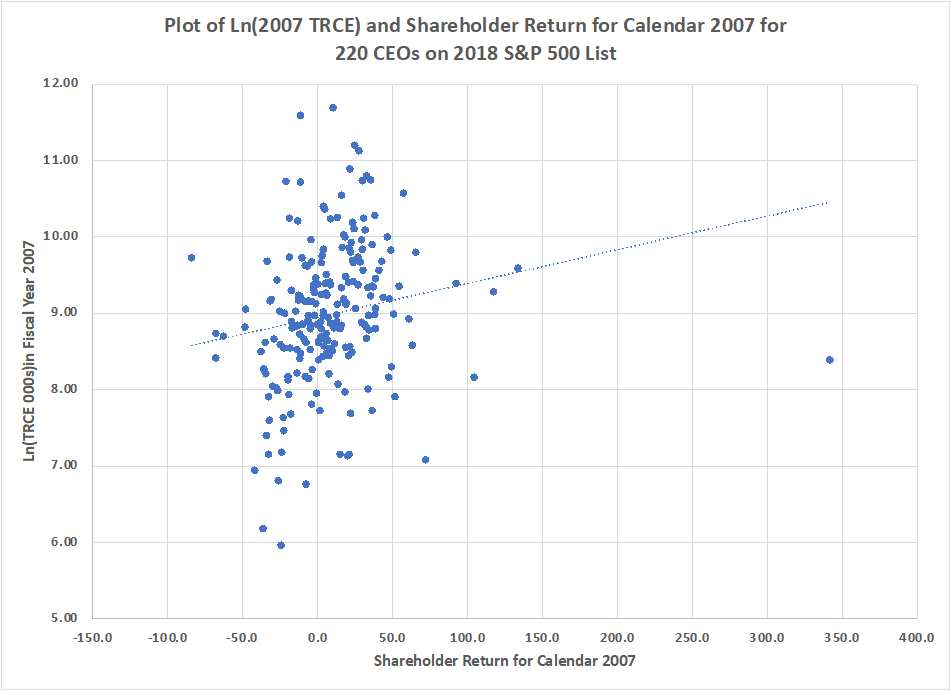

The t-statistics mean more to the academics and practitioners who use them frequently than to most executives, even if they have earned an MBA. That is because t-statistics are not intuitive. Chart-3, Chart-4, and Chart-5 provide a more intuitive illustration of the advantages of measuring pay and returns over the CEO’s complete period of service and the explanatory power of the t-statistic of the shareholder return coefficient.

Chart-3

Chart-3 is a plot of annual shareholder return for 2007 and the natural logarithm of compensation measured by TRCE for that year. It employs data for 220 of the 521 CEOs using the data for all of the CEOs whose tenures included 2007. The chart clearly reveals why many who examine annual measures of pay and return conclude the two are unrelated or have a very weak relationship. The chart contains a disorganized blob of points because option exercise distorts annual pay. The average value of TRCE for the 124 CEOs who exercised options in that year was $16.5M, with approximately $9M of that amount obtained from option exercise alone. The average total compensation (TRCE) for the 96 CEOs who did not exercise was slightly less than $7M, which is $2M less than the average value of exercised options. Those outcomes make it impossible to detect any relationship between pay and shareholder return.

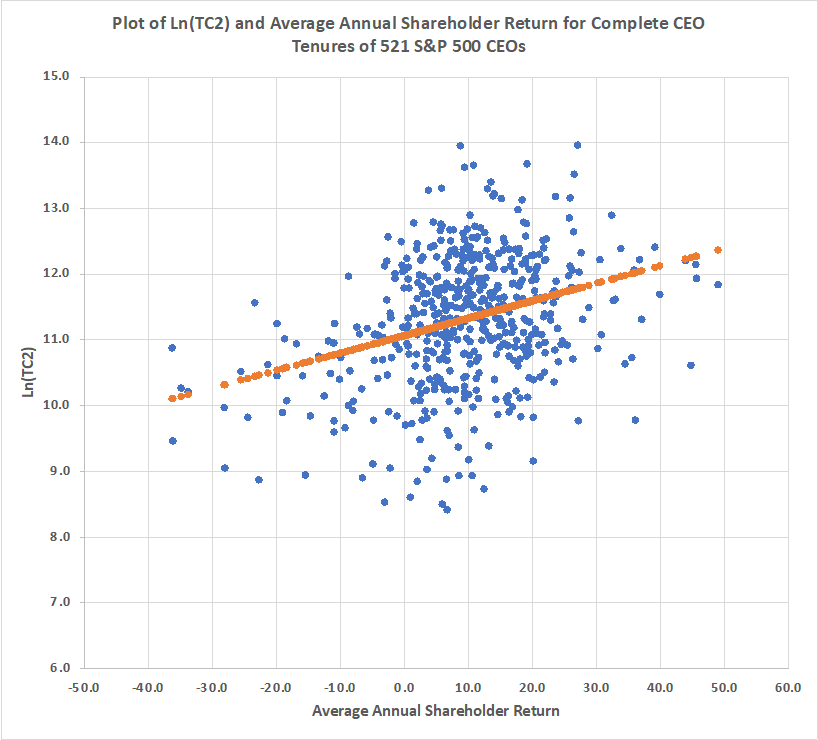

Chart-4 is a plot of the natural logarithm of TC2, the total compensation received by a CEO over his or her period of service, and the average annual shareholder return achieved over the same period. There is a much more noticeable positive relationship between those two variables than is apparent in Chart-3.

Nonetheless, Chart-4 greatly understates the association between shareholder return and CEO pay because variables other than shareholder return influence pay. The most important of those other variables is the length of the CEO’s tenure. Chart-4 includes data for 521 CEOs whose periods of service vary from three to 19 years. The regression results reveal that an additional year of service boosts TCE by 13 to 14 percent. To construct a chart that reveals the effect of shareholder return alone, it is necessary to remove the effects of determinants of pay other than shareholder return.

Chart-4

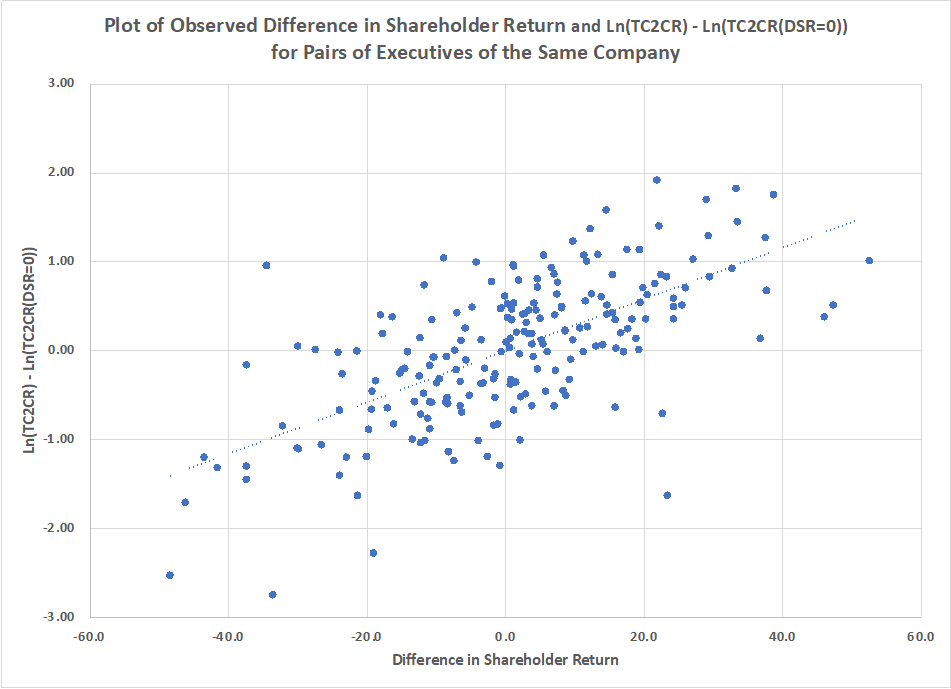

Chart-5

Chart-5 contains a plot of shareholder return and CEO pay measured over full periods of service with the pay measure adjusted for the effects of variables other than shareholder return. It is derived from the difference regression and employs the logarithms of two compensation ratios. One, TC2CR, is the observed compensation ratio for two CEOs who served consecutively for the same company. The value of TC2 for the first CEO is in the denominator and the value for the second in the numerator. The other ratio, TC2CR(DSR=0), uses the coefficients from the difference regression and differences in the values of the independent variables for the two CEOs to estimate the value of the compensation ratio if there were no difference in achieved shareholder return for the two CEOs.

If the influence of shareholder return on pay is pronounced and the second CEO achieves a shareholder return much larger than that of the first, the difference in shareholder return is large and positive, and the differences in the two compensation ratios and their logarithms should also be large and positive. If it is the first CEO who achieves the much larger shareholder return, the difference in shareholder return is negative and the differences in the ratios and their logarithms should also be negative. The pronounced pattern of positively aligned points in Chart-5 depicts that pattern of variation. It is the image of a t-statistic that has a value of 11.1 and reveals the pronounced impact of shareholder return on CEO pay when both are measured over the full period that the CEO serves.

Summary and what’s next.

In this blog I described my efforts to examine the relationship between shareholder return and CEO pay. That effort produced two discoveries, one far more surprising than the other.

First, I documented a strong relationship between CEO pay and shareholder return. That should surprise no one, because it is a logical consequence of the extensive use of options in CEO pay packages. The options of CEOs who have engineered large shareholder returns will be worth more than those of CEOs who have engineered returns that were much smaller or very disappointing. As a result, my pay measure that includes the value of exercised options must be correlated with shareholder returns. My only contributions were to explain why detecting this relationship requires that an investigator measure pay and returns over a CEO’s full period of service and to complete the tedious computations necessary to obtain those pay and return data.

Since 2000, the proportion of S&P 500 CEOs receiving options in a given year has declined more or less steadily from slightly over four-fifths to nearly one-third. Over that same period, the proportion receiving stock grants has increased from one-fourth to more than nine-tenths. I am in the process of investigating whether that shift in the compensation components has reduced the strength of the relationship between CEO pay and shareholder return. If I find an answer, I will report the result in a future blog.

Second, I established that shareholder return and the market return have opposite effects on CEO pay and that they are approximately equal in absolute size. I find that result very important. I am surprised by it, even though boards should make pay decisions that produce it, because I was not certain the data would allow an investigator to make definitive claims about the signs and magnitude of the shareholder and market return coefficients in a pay regression. The discovery refutes the claims of those who argue that the use of options inflates CEO pay in bull markets, even for CEOs who produce mediocre results. My results imply that higher shareholder returns will boost pay over the full period of service only when they exceed the market return.

I have not demonstrated that shareholder returns are higher because boards make options an important part of pay, nor have I shown that all CEOs are appropriately paid. In my published paper, I identify CEOs of Viacom and CBS, which is owned by Viacom, who were paid extraordinary amounts when they delivered disappointing or unexceptional returns. But my work does constitute a challenge for the critics of CEO pay. They, in ways similar to Piketty, typically premise their arguments on the claim that there is no pay for performance, which I have shown is not the case. To be credible, the critics need to put forward suggestions for methods of compensation that result in smaller paychecks but have no adverse effects on shareholder returns.

Indeed, the movement away from options and toward stock grants suggests that boards are looking for those pay procedures. Options produce a mechanical link between returns and pay. When granting them, however, boards cannot be sure the resulting pay amounts will not be excessive. But I do show that there is evidence of pay adjustments when option grants prove lucrative to CEOs whose efforts were unexceptional.

The critics of CEO pay also cite increases in the ratio of CEO pay to pay for the median worker as evidence of excessive pay. Lardner in his New Yorker essay blurts out that for Walmart, the CEO’s pay is 1000 times larger than that for the median Walmart employee, no doubt hoping to shock the magazine’s readers. I am not among the shocked, because we have no theory that predicts how large the ratio should be and no theory that would support the claim the steady rise in the ratio suggests that markets are not functioning properly. We certainly are unable to say that the ratio should have the same value for every company, which suggests that Senator Bernie Sanders should rethink his proposal to link the corporate tax rate to the CEO-median-worker pay ratio.

If Walmart’s CEO has recently exercised options, a large ratio would not be surprising. Furthermore, the company operates conventional retail stores and has grown as an Internet retailer. Lardner presents no argument suggesting that the combination of those challenges cannot explain an unusually large pay ratio for the current CEO. Similarly, without knowing what has happened to the complexity of the CEO’s job and the complexity of the tasks completed by the median worker, it is impossible make definitive statements about the direction of change in the ratio of average CEO pay to median worker pay.

In the future, I intend to explore different ways of calculating this ratio and look for the determinants of its trend. I also plan to look how comparable ratios have changed for other occupations. In particular, I plan to calculate the ratio of the pay of surgeons to that of primary care physicians, as well as calculate the ratio of the average pay for the 10 or 20 highest paid baseball players to the median salary of a player on a MLB roster. I will report what I find in a future blog.

1Lardner, James, “Inequality Has Soared During the Pandemic – And So Has C.E.O Compensation,” New Yorker, June 30, 2021

2 I examine income inequality using IRS data, which is not released until all returns, including those with extensions beyond the April deadline, are filed and processed. The most recent year for which data is available is 2018. Data for 2019 will be released this fall. I calculate the percentages using a measure of income that adds untaxed Social Security income and pensions to Adjusted Gross Income. The Social Security amounts were first published in 1984. I also calculate percentages using a second income measure that adds to the first untaxed interest, first published in 1987. The addition produces tiny increases in the income percentage and no changes in the comparisons based on the first measure.

3Piketty, Thomas, Capital in the Twenty-First Century Kindle Edition - Location 517

4Francis, Theo and Joann S. Lublin, “CEO Pay Shrinks 4.6% but Offers Weak Reflection of Performance,” Wall Street Journal, June 2, 2016

5The pay data on which this essay is based are taken from S&P’s EXECUCOMP database, which contains two measures of total pay. One includes the value of options in the year they are granted and the second adds the value realized when options are exercised in a given year. I use the second measure because it is the best indicator of how much the CEO receives. For this measure, options have no effect on pay in those years when the CEO does not exercise options.

6Chart-1 reflects data for CEOs of companies on the S&P 500 list for 2020. The number of executives varies year by year because some companies on that list were not S&P 500 companies in early years. For both those who exercise and those who do not, the means reflect data for at least 100 CEOs, except for 1992 and 2020, when both groups have less than 100 observations and 1995 when the mean for those exercising is less than 100. For all of the years from 1998 to 2019, together the two groups represent at least 300 CEOs, and from 2006 to 2019 they represent more than 400 CEOs. The number of CEOs for 2020 is small because many companies had not yet filed compensation information for that year when I obtained the data.

7Schmidt, Ronald, “The Relationship Between Shareholder Return and CEO Pay Over a CEO’s Full Period of Service,” Journal of Applied Corporate Finance, Volume 33 Number 1. I will provide an electronic copy to anyone wishing to read the paper.

8The dependent variable in the regression that best fit the data was the logarithm of TC2. The regression had an intercept term. The independent variables were the length of the period of service, the average shareholder and Value-Weighted returns for the CEO’s period of service, the logarithmic value of assets and employees, the average value of the CEO’s holding of company stock over his or her period of service and indicator variables for utilities and financial service companies. All eight variables were statistically significant.

9The dependent variable in the regression is the difference in the logarithms of TC2 for the two executives, which is the logarithm of the ratio of the two values of TC2 for the executives. The intercept term is very small. The independent variables were the length of the period of service, the average shareholder and Value-Weighted returns for the CEO’s period of service, the difference in the logarithmic value of assets and the difference in the average value of the CEO’s holding of company stock over his or her period of service. All five variables were statistically significant. The correlation coefficient for the variables reflecting the difference in assets and difference in employees is high. The employee variable is significant when it appears in a regression that does not include the asset difference.

Follow the Dean’s Corner blog for more expert commentary on timely topics in business, economics, policy, and management education.

Ron Schmidt is the Joseph T. and Janice M. Willett Professor of Business Administration at Simon Business School.

To view other blogs in this series visit the Dean's Corner Main Page